2024 Q3 Global Freight Transportation and Logistics Trends

Global Macroeconomic Trends

Global GDP growth projections have increased with a stronger second half of 2024 expected in China and Europe.

Global GDP growth projections have increased with a stronger second half of 2024 expected in China and Europe.

Key Macroeconomic Indicators Summary

Key Macroeconomic Indicators Summary

1. Exports have been revised slightly up to 3.02% globally, with the US seeing a significant decrease while Europe and China both project growth

2. Industrial Production increased slightly with China and APAC increasing while both the US and Europe project sightly negative growth

3. Retail Sales forecasts decreased slightly with the US and Europe declining and minimal increases from China

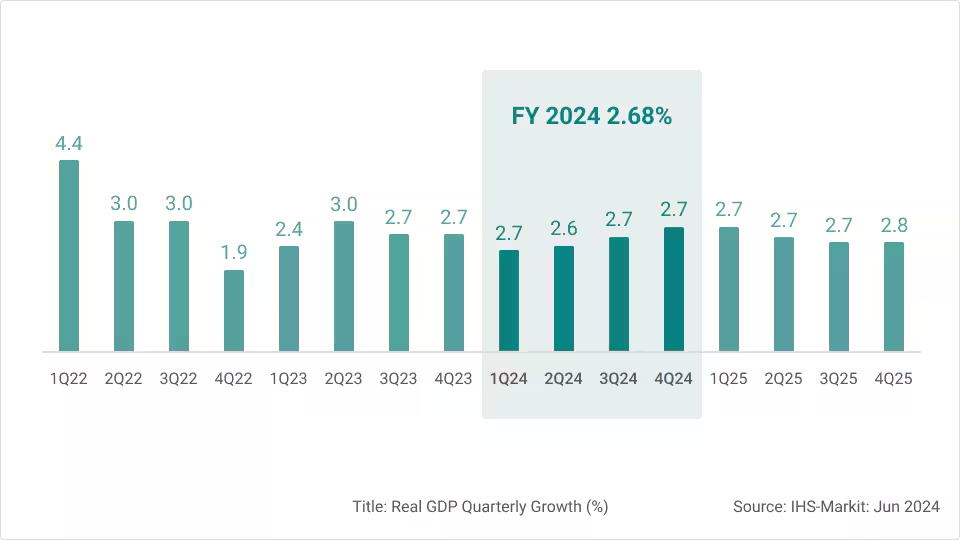

Real GDP Quarterly Growth

Real GDP Quarterly Growth

1. World GDP growth forecasts for 2024 have been revised up from 2.57% in March to 2.68% in June

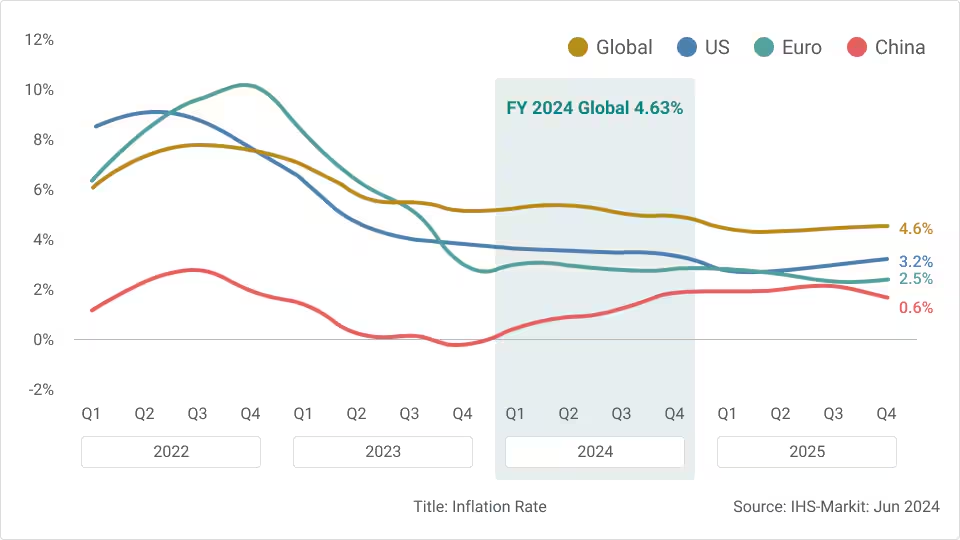

Inflation Rate

Inflation Rate

1. The global annual inflation rate has been revised slightly downward from March (4.8%) to June at 4.6% with slightly lower inflation for 2H 2024.

2. Inflation rates in China saw a revision down from 1.0% to 0.6% for 2024, with higher inflation impacting the economy in Q3 and Q4, well below March projections and significantly below global inflation rates.

3. US inflation rate forecast increased to 3.24% in June, up from 2.98% in March, with inflation rates above 3% in each quarter of 2024.

Global Logistics & Distribution Trends

Contract Logistics & Warehousing Continue to be in High Demand.

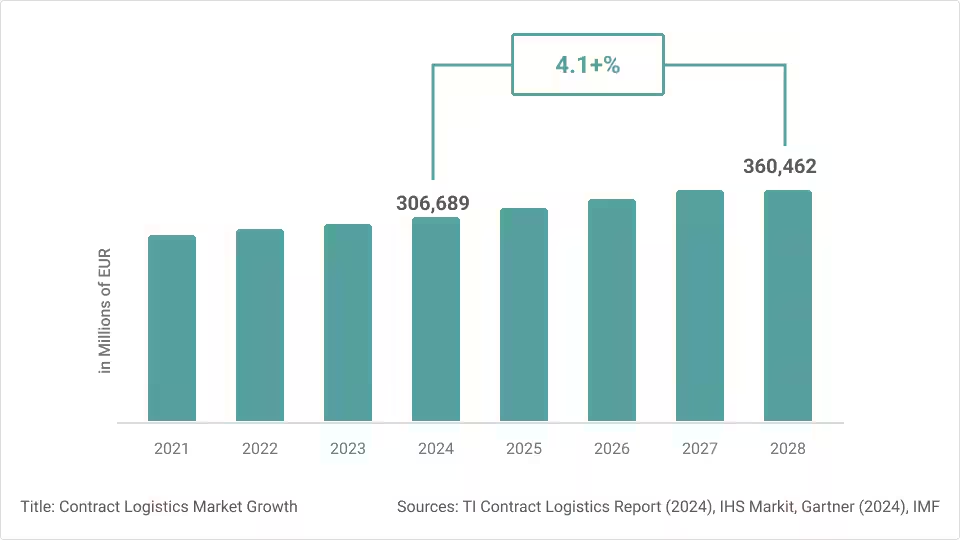

Contract Logistics Market Growth

Global Contract Logistics to Accelerate in 2024, Growing by 4.2% YoY

1. Global headline and core inflation is expected to decline steadily over the next 2 years.

2. Policy rates of central banks are expected to decline in 2H 2024 among advanced economies.

3. Contract logistics market continues to outpace global GDP (2023-2024 YoY 2.7%, 2024-2028 CAGR 2.8%).

4. Implications: Possible increase in consumer spending as a result of lower interest rates and decreased inflation.

Globalization Shifts

Globalization Shifts Drive Logistics Reorganization in APAC

1. Asia Pacific region propels the global market with a 7.1% YoY growth due to resilient domestic consumption and strong public investment in China and India.

2. Investment will continue in APAC, but a reshuffle of the current footprint will occur without decreasing China’s importance as a manufacturing country.

3. Implications: Companies that currently manage logistics in-house may consider outsourcing their operations.

Market Trends

Market Trends

1. Warehousing costs are expected to increase, more so in Western economies than in North-East Asia.

2. Logistics networks continue to adapt to the changing needs of e-commerce retail-driven businesses with increasing volumes, faster delivery and need for reliable timelines and escalating cost-to-serve pressures.

3. Implications: 2H 2024 expects to see excess capacity being soaked up by demand as warehousing construction slows.

This document is for informational purposes only. It does not constitute legal advice. Information herein was obtained from government, industry, and other public sources. It has not been independently verified by UPS and is subject to change. Recipient has sole responsibility for determining the usability of any information provided herein. Before recipient acts on the information, recipient should seek professional advice regarding its applicability to the recipient's specific circumstances.